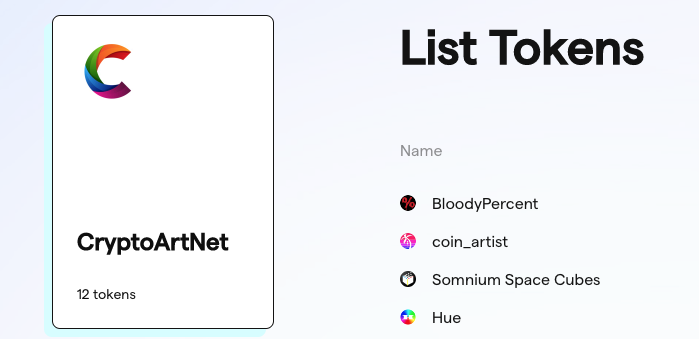

Though most of CryptoArtNet’s posts on cryptoart as an asset focuses on art NFTs, Ethereum blockchain-based tokens are also worth considering. CryptoArtNet’s Uniswap cryptoart token list is one effort to support those entering that realm. Of course, $WHALE and $RARI are both worth learning more about. Cryptoart investors and speculators can also learn a few things from NFT traders and blockchain research.

CryptoArtNet’s Uniswap Token List

Currently in queue to be considered as an addition to Uniswap’s Token Lists, CryptoArtNet’s cryptoart token list features cryptoart-related tokens listed on Uniswap. You can add it to the Uniswap app using the url of the json list on Github. This list will be maintained and updated regardless of Uniswap’s decision to add or reject the list.

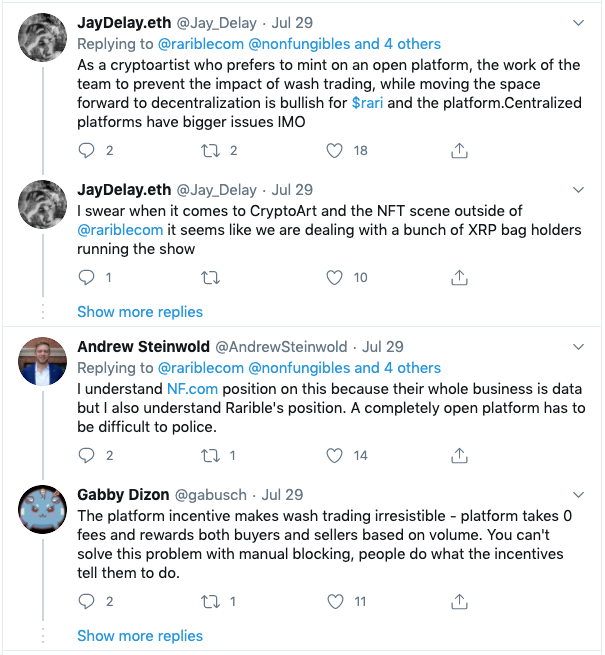

$RARI and Rarible Governance

After successfully launching its $RARI governance token, Rarible follows with an explanation of how governance will work. The ultimate goal is to create a DAO, a Decentralized Autonomous Organization. This goal has received a major cosign with the decision of CoinFund to invest in Rarible. It’s pretty clear the scrappy marketplace that has attempted to serve the community as a whole is leveling up.

Brukhman on CoinFund’s NFT Thesis

Ok, it’s clear I’m going to disagree with Brukhman’s take on the NFT space on a regular basis but he’s an important voice and his leadership of CoinFund will have enormous impact beyond its recent investment in Rarible.

So here’s Brukhman’s most recent analysis of the bigger picture, “All digital content is going on-chain,” which addresses “CoinFund’s NFT thesis and…investment in Rarible.”

$WHALE NFT Mining

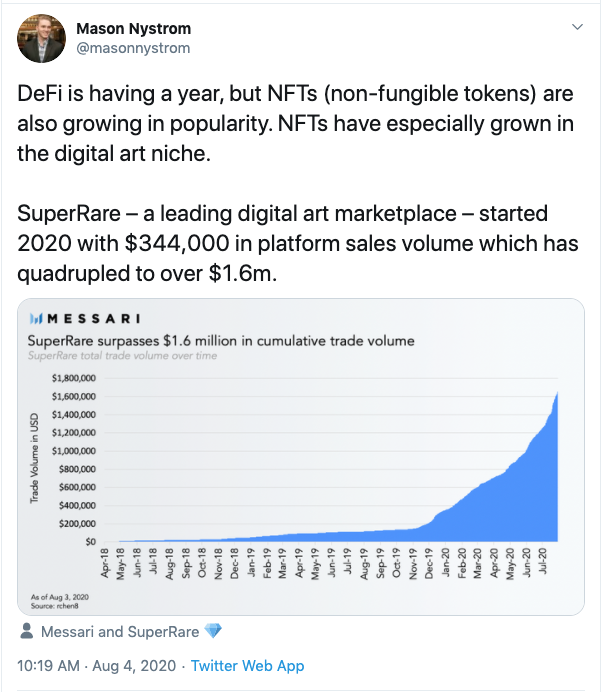

Though recently blocked by @WhaleShark_Pro, I continue to follow news of $WHALE, an innovative token with a deeply committed community. Mason Nystrom recently shared an introduction to the token in the Messari newsletter with a deeper dive for subscribers.

Also worth noting is WhaleShark’s recent explanation of the $WHALE NFT Mining program in which “NFT meets DeFi” and very recent coverage by CoinTelegraph:

“Whale vault gobbles up virtual real estate for development in The Sandbox”

CV VC Global Report – Blockchain in Art

I previously mentioned the CV VC Global Report on “Blockchain in Art” which was released as a “Sneak Peak.” This week they organized the above panel to discuss topics considered in the report.

Blockchain, Creativity and Arts Intertwine

In an extensive post on Medium, “Blockchain, Creativity and Arts Intertwine,” Sasha Shilina shares “Use Cases and Notable Projects” that should be of great interest to cryptoart collectors in the larger context of blockchain-related art activities.

Reference: UBS Art Basel Art Market Report 2019/2020

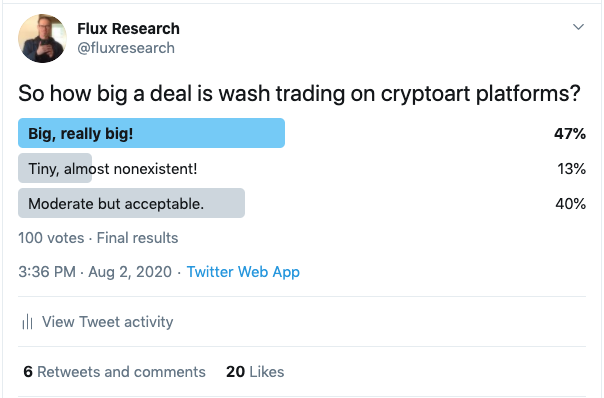

CryptoArt/NFT Collecting and Trading

Art is Becoming the Next Billion Dollar Blockchain Use Case & You Don’t Need Millions to Get Started – DCL Blogger

How Ethereum fuelled the NFT boom – Robert Stevens

An ROI Collector’s Guide to Cryptoart – matthew

Exploring On-Chain Data To Find The Best NFT Traders – Andrew Steinwold

The Complacency of Crypto Art

For a deep counterpart to most of the above perspectives, DADA.art’s Beatriz Helena Ramos shared her thoughts earlier this summer on “The Complacency of Crypto Art.”

Did you know you can Subscribe to CryptoArt News?